The forex market is surpassingly brutal to its traders. Right?

You can’t believe the heartless market, your analysis, executed trade, indicators, provided signals, or anything else except one thing. It is a stop-loss order.

Trading is a number game. Proper risk management and extremely disciplinary actions are a must to survey here. Using a stop loss in forex trading is an essential pillar of risk management.

Rocky traders do not fully understand what stop-loss is and the importance of it. Here we will discuss all of the main points related to a stop-loss in forex.

Let’s learn some effective strategies for placing your stop orders.

What is a Stop-loss Order in Forex Trading?

A stop loss is an order that you place to secure your capital from being blown. It helps you close out your trading position effectively with limited losses when the price hits a predetermined level.

In short, stop-loss is a secondary order placed to protect a trader’s account from severe losses in a particular trade.

Why Trading With a Stop-loss Order is Important?

Forex market doesn’t care about your emotion or your killer analysis. It is complex to understand, hard to deal with, and undoubtedly uncontrollable. We stake our hard-earned money in this rude game believing in probability.

No matter how beautiful setup you find out, the forex market may go opposite to your direction. No traders can predict the exact future of the market. Major economic events, Global politics, to central bank rumors can turn currency prices one way or another so faster than you can imagine.

In this hostile trading planet, your oxygen is proper risk management. And it’s all about managing your trade over your emotion and managing your risk-reward ratio following your invested capital. All of these are possible if you strictly use stop loss in trading.

If the price goes in the unexpected direction and the trade becomes unprofitable, the stop-loss helps mitigate your losses.

The importance of using stop loss in forex trading is a lot. It helps you out to eliminate emotions from your trading decisions.

It manages your trading psychology. Having a predetermined exiting point of a losing trade helps you eliminate the unknown’s fear by removing unwanted risk.

The purpose of using stop-loss orders in forex is to ensure bearable losses. It helps them to survey in this market with moderate pressure.

Less pressure is good, right?

How Does a Stop-loss Order Work?

A forex trader assigns a logical stop loss before placing a trade. When the price reaches the predetermined stop loss level, the transaction closes automatically.

A logical stop-loss setup may help the traders control fear and anxiety when executing an order to protect the rest of your invested money.

How to Calculate Stop Loss?

Before executing a trade, you have to be very clear about the amount of money you are going to risk on it. So you have to ensure how many dollars of your account you have at risk.

You can calculate your risk dollars as

Pips at risk X Pips value X position size

Here is an example of calculating stop loss on a forex pair:

Pair: EUR/USD

Pips at risk: 10 Pips

Pips value: $1

Position size: 3 mini lots

So,

we are risking= 10 pips at risk X $1 per pip X 3 mini lots= $30 (plus commissions)

How to Control Account Risk?

The amount of money traders is risking per trade is only a small portion of your overall trading capital.

The amount of money traders risk per trade should be below 2% of their account balance.

If you take $30 per trade and it is 2% of your trading account, then your invested capital will be $30 X 50 = $1500

1% risk per trade means you have risked 1/100 of your account. Before executing a trade and placing a stop-loss order, you have to determine your position size with the position size calculator.

Strict with your risk-reward ratio. Suppose you are willing to lose $10 on 15 pips in a trade. The profit target should be $30 or 45 pips to give you a risk to reward ratio of 1:3!

I hope you understand.

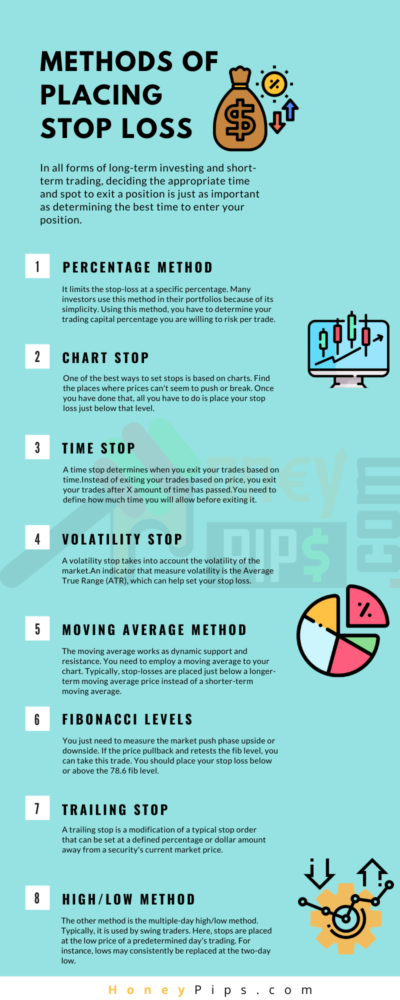

Methods of Determining Where to Set a Stop-loss Order

Many traders have a tough time determining where to set their stop-loss levels with acceptable risk.

There are plenty of methods to set stop loss. These are:

- Percentage method

- Chart stop

- Time stop

- Volatility stop

- Moving average method

- Fibonacci Retracement levels

- Trailing Stop

- Multiple-day high/low method

Percentage Method

The percentage stop is one of the most popular methods of setting stop losses.

The percentage method limits the stop-loss with a predetermined portion of the trader’s account. It is a method of placing a stop loss based on the size of the trading capital.

The recommended percentage of stop-loss is 1-2% of the total investment. It varies from trader to trader. More aggressive traders take risks up to 10% of their accounts, while conservative ones usually have less than 1% risk per trade.

For example, your capital is $10,000. Your allowable risk per trade is 2% of your account. Then you should calculate your position size with the amount of risking $200 for each transaction.

Many investors use this method in their portfolios because of its simplicity. Using this method, you have to determine your trading capital percentage you are willing to risk per trade.

Chart Stop

You can determine stops based on what the charts are saying.

In this method, you have to identify recently created support and resistance level. When the identified support or resistance is retested, it could potentially hold.

Setting stops beyond these valid levels of support and resistance is reasonable. Because if the market breaks those areas, the trade might go against you.

Have a look in this screenshot:

We execute a trade with the bullish engulfing confirmation candle. The market push a little bit against us. But we are protected by a strong support. You can use support, resistance, trendline, channel, supply and demand zone as price barrier to place your stop-loss order.

Time Stop

The time stop is set based on time parameters. This stop-loss order technique can be automated or manual.

It is also called “time-based stop-loss.” It allows the traders to seek better market opportunities for their trading capital. It is one of the best stop loss strategy for those who prefer not to leave their trades open overnight, over the weekend, or end of the trading session.

As an intraday trader, you can take this as a stop-loss strategy for day trading setup. It keeps you out of that trade where your money is captivated in no movement pairs. You can seek for better trading opportunities elsewhere for your capital.

As a swing trader, you can use this stop loss theory to decide on closing your positions on Friday to avoid risks associated with market gaps and weekend events.

Time stops are often used in low volatility ranging market, where the market goes neither your stop loss nor profit target for a certain period.

Finally, you have to remember that risk management rules also support time-based stop losses. Use this stop-loss strategy in conjunction with a preset stop loss and profit target.

Volatility Stop

According to Wikipedia, volatility is:

“the degree of variation of a trading price series over time…”

So, volatility is the amount of the market’s move over a given time. It offers a logical method of placing a wide enough stop-loss to let the market wiggle so that traders cannot stop out prematurely on random fluctuations of price.

Volatility takes into account the real market situation. For example, if you are a swing trader and you know the average daily range of EUR/USD is 100 pips over the past month, setting your stop to 15 pips will probably get you stopped out too early for market noise.

Average true range (ATR) and Bollinger bands are used to spot a logical exit point if the trade goes against prediction.

Volatility is an extraordinary tool to help you place great stop-losses, which give your trade enough room to breathe and a chance to be right.

Moving Average Method

It is the simplest method of setting a stop-loss order. The moving average works as dynamic support and resistance.

To use this technique, you need to employ a moving average to your chart. Typically, stop-losses are placed just below a longer-term moving average price instead of a shorter-term moving average.

It helps you avoid setting your stop loss too close to the entry price and getting stopped out of your trade too early.

- Insert moving average in your chart

- Enter after price find support in the long term moving average

- Place your stop on the opposite side of the moving average

Fibonacci Retracement Levels:

Fibonacci levels can also be used to placing stop loss.

You just need to measure the market push phase upside or downside. If the price pullback and retests the fib level, you can take this trade. You should place your stop loss below or above the 78.6 fib level.

If the market breaks that level and hit your SL, your trade may no longer be valid.

Trailing Stop

A trailing stop is a stop-loss order that moves in favor of your position in a certain percentage, pips, or dollar amount away from the current market price. It reduces your risk as the trade develops in your turn. It is continuously locking your profit.

You may hear this phrase, “Let your profits run; cut your losses short.” Right? It is possible by using a trailing stop.

Remember, never let your winning trade become a losing trade. Always strict to trailing stop loss.

Multiple-day High/Low Method

The other method is the multiple-day high/low method. Typically, it is used by swing traders.

Here, stops are placed at the low price of a predetermined day’s trading. For instance, lows may consistently be replaced at the two-day low.

I don’t think it is the best Forex stop-loss strategy, but it deserves to be included in this article.

These are how you can set your stop-loss order in forex. Now the question is, which one of the mentioned methods of placing SL is the best? Well, we can’t say for sure. You can choose one which is the most logical and straightforward to you.

What to Consider with Stop-Loss Orders?

Stop-loss order is a double-edged sword. If it is misused, it can wreak havoc on your portfolio and end your budding trading career in a flash. So considers the below-mentioned issues during stop-loss placement and management.

- Stop-loss order is crucial for those who have not enough time to monitor their trade.

- Before entering into a trade, you need to be very clear on the level of risk you will take in that trade. If you have no idea where you should place your stop-loss or when to get out of that trade, then don’t take this trade.

- Double-check the chart to ensure that your stop-loss order is placed at the desired level.

- Always keep an eye on how much charges brokers imposed on you for different orders.

- Evaluate your trading plan to have crystal clear ideas on your risk management for proceeding with stop loss placement.

- Always consider the price volatility of the pair. For example, if the average daily range of EUR/USD is 100 pips, placing a 10-pips stop loss while entering a long or short position on the daily chart will most likely close your trade in a matter of minutes.

- Using stop loss is most useful for day traders.

Common Mistakes to Avoid When You Place Stop Loss

Poor stop-loss order placement and management cost you a lot of money. Let’s talk about the most significant mistakes forex traders make on stop placement and management.

- Too far stop loss: The first common mistake beginners make in setting stop losses is placing them too dang tight. Fear of losing trade is the main reason for this type of practice. It is most common among the rocky traders and those transitioning from demo to live to trade. They set their stop loss so tight that there is no room to breathe or price fluctuation. Price could spike around first to stop out retail traders before picking a clear direction because of the volatility. So you should give your trade enough room to wiggle and take volatility into account. Once the price hits your stop, you should skip it out and move on the look for another trading opportunity. Widening your stop-loss brings nothing to you. You’ll just only aggregate losses in the long run. Besides, if you set too wider a stop, it increases the number of pips your position needs to move in your favorable direction to make your trade worth that risk.

- Placing stops too dang tight: Not setting stop-loss levels too close. It causes the loss of money by being taken out of your trades too early. As the market can fluctuate unpredictably in short periods, you should give the price enough room to “breathe” when placing your stop order. It protects your stop from sudden volatility in the market.

- Not determining your stop-loss placement in advance: You should know where you should place your stop loss before opening a trade. It helps you to remove any emotions from your decision-making process.

- Placing your Stop Order Based on Arbitrary Numbers: The forex market doesn’t care about your emotions, belief, trading plan, risk-reward ratio, magic price level, or some other bullshit facts that have means to you. One of the big mistakes traders makes to try to make the market fit with their framework. They should fit their framework with the market. There are no magic numbers or equations that guaranteed your stop loss. So, place your stop orders based on actual market behavior.

- Moving your Stop to Break Even ASAP: When you enter a trade and place your SL, it means if the price goes above/below the invalidation point, then the reasons for executing the trade will have been invalidated by the market, and then you are almost unquestionably wrong on your analysis. But if your emotion and fear trick on you to move your stop loss at break-even quickly when the price moves few pips in your favor, it may result in unexpected losses. It is contradictory to stop loss purposes. Stick to your trading plan. It helps you to overcome the emotional trading. Don’t get too excited to move your stop loss without proper analysis of the market scenario.

- Setting your Stop at Pockets of Liquidity: It is the gravest errors of rocky traders to place their stop loss directly above/below crucial swing highs/lows and clean equal highs/lows as these are the regularly raided liquidity area. There is always a good chance the market will spike through them before reversing.

- Never Moving your Stop: If the market proves that it is moving in your expected direction, Traders can move your stops to break even with spread or trail to lock some profit. But the condition is it should not be an emotional decision. Trail your stop loss based on your technical analysis to maintain a good R: R. It is not contradictory. You can move your stop slightly lower if the price breaks a support level and indicates that it may further fall. If the price managed to break a critical resistance level and other factors show a clear uptrend, you can move your stop loss higher.

- Placing stops exactly on support or resistance levels: Placing stop orders precisely at the support/ resistance levels may be risky as the market may return to these levels after the breakout and trigger your stop before heading your direction. You should always place the stop order a few pips above or below these levels.

- Trading Too Large Position Sizes: When you are in trading, always keep your mind the position size. Risking too much of your total trading capital on any one trade is a horrible habit. Determine your position size based on risk per trade and always use sound analysis to place your stop orders.

Now that you’ve learned these mistakes on stop-loss order placement. Think about them and figure out how many of these mistakes you’re making. Corrects them and being a prudent trader.

Crucial Rules To Follow When Using Stop Loss Orders

There is no holy grail formula for making money, but it is impossible to make money in the forex markets without taking on risk. Stop-loss orders are the most simple and effective way to control that risk. Understanding some simple rules will help you to use them successfully.

- Never place your stop-loss levels at random locations: Your chosen method should be transparent to you and testing out and practicing multiple times. Find out for yourself which approach suits you.

- Use a simple stop-loss strategy: Trade in the overall trending direction with a simple stop loss method. Don’t complex your trading journey with multiple stop loss method. Choose one which is logical and straightforward to you.

- Maintain Risk and Reward Ratio: Always consistent with your risk-reward ratio. The risk-reward ratio determines your potential reward for each pip you risk.

- Don’t pour all your capital into one trade: Use good judgment and proper risk management techniques over your emotion. Don’t pour all your hard-earned money into one trade.

- Respect technical indicators: The technical indicators are telling you a story about the market. Once the indicators indicate a trend is close to its top, trail your stop loss to lock your profits.

- Do trail your Stop: A trailing stop moves in the desired direction of a lucrative trade by a predetermined amount of pips. It reduces your risk, locks your profits, and still gives the price enough room to wiggle. Always set a reasonable pip-amount for your trailing stop. Very few pips trailing stop would not be of much help, and you could stop out prematurely. Always adjust your stops. It helps you to ride a massive trend.

- Don’t let emotions move your stop loss: Once the market price goes against you and hovers very close to your stop order, it might be alluring you to move the stop. It’s a psychological trading mistake. Control your emotion. Use your head so that your stop adjustments will be logical, not emotional. Never let emotions override your analysis. Otherwise, you lose more money in the long run.

- Don’t Use Round Numbers: The market will often touch a round number or obvious chart point. Taking a loss of a few pips more is worth it to eliminate that risk. So, never place your stop orders at exact round numbers. Always put your stops a few pips above or below the obvious round numbers. It protects your stops a little bit against false push up or down.

Remember, your financial future is at stake here. So strict to these rules.

Hidden Tricks to Set Stop Loss Order in Forex

Actually, there aren’t hard and fast rules for stop loss placement. Don’t place a stop-loss order blindly above a swing high when shorting or below a swing low when buying. If you get any comparative advantages, you can put your stop-loss orders at an alternative spot on the price chart. Here are some hidden tips and tricks for you about the stop-loss placement that nobody told you before.

- Stop-loss range: Professional traders don’t recommend fixed stop loss on every trade. They think it is a big mistake for rocky traders. But if you are very tight-fisted about your stop loss size, you can be strict. You can hunt the trades when the market price reaches your stop loss range. Confusing, right? Let’s make it simple. Suppose you never want to take more than 15 pips stop-loss per trade. Now, what can you do? You have to find a secure spot on the chart for stop order placement. Then keep placing your pending order with 15 pips stop above or below the entry point. When the price reaches to your stop-loss range, your trade will be executed. You are in the trade, but your stop-loss is fixed to 15 pips always. The problem is you can’t catch many trades as the price would not trigger your pending order all the time.

- Strong number concepts: 20, 50, and 80 are called a strong number in trading. So, 1.1220, 0.5680, 132.50 etc. are the substantial price to break as the last two decimals of these numbers are the firm number. These types of numbers are significant barriers to the market to breach. So, try to place your stop loss above or below these concrete numbered prices that are hardly be pushed. It increases your trading odds and winning ratio.

- Slipping point: It is a critical spot of your trading chart where lots of traders are stuck with their wrong directional trading position. Here lots of traders get relief from their losing trade, lots of traders close their winning trade, and lots of them open new positions. It is a turning point in the market. So, you can place your stop order just a few pips above or below these kinds of spots.

You can use above mentioned three stop-loss strategies to increase your trading odds in your forex trading career.

Frequently Asked Question

Once you blow your trading capital, there is no way you can make back the hard-earned lost money. So you have to strict with your trading plan and risk management.

Stop-loss helps you to manage your trade efficiently under risk management techniques.

Here are some answers to frequently asked questions about stop loss. If you have any relevant questions, leave the comment below.

Should intraday traders use stop-loss orders?

I think so. Intraday trading is very much risky. As intraday traders cash in on market volatility to make a profit and their trades’ life span is small, they should use stop loss.

Should long-term investors use a stop-loss order?

Short term price changes have fewer effects on long term trade. So, long term investors usually skip using stop-loss.

Can market makers see stop-loss orders?

Yes. CFD brokers can be the market makers as well. They can see your stop losses. Sometimes brokers provide this information to high-frequency traders, and stop-loss hunting has occurred in forex.

Can other traders see stop-loss?

No. Other retail traders can’t see your stop-loss.

How many pips should be stop loss?

It depends on your trading style. Swing or position traders usually comfortable with 30-50 pips stop loss. Day traders should take 15-25 pips SL per trade. Remember, you may stop out soon by market noise if you use too much tight stop loss. Too wide stop-loss causes you to lose too much.

The Bottom Line

Stop-loss order is an essential element of the trading system. It makes your trading system more secure and controlled.

Your stop-loss should only be hit if your prediction is wrong. It is the invalidation point of your trading idea. So, place a stop loss as soon as you place an order.

Remember, Holding a losing trade is not courage. Getting out of that trade with the confidence that you will make it back in another trade is real courage.

We hope that this content has fully addressed almost all the issues regarding stop-loss order in forex trading. If we have missed something else, leave the comment below. We will cover it as soon as possible.

Happy Learning!