FTR or Failed to Return is a power chart pattern used in supply and demand trading. It is an important pattern that can strengthen your technical analysis and increase your trading odds.

In this article, I will cover this pattern in depth.

What is FTR in Trading?

You may google it many times to find the precise definition and simple discussion on FTR. But you hadn’t got the exact answer. Right?

No problem, now I am telling you this.

FTR is a popular chart pattern in the trading industry. When price breaks an SR with a new high/low, push back to collect orders and breach the new high/low; then FTR is generated.

Let’s drive in-depth to have a better grasp.

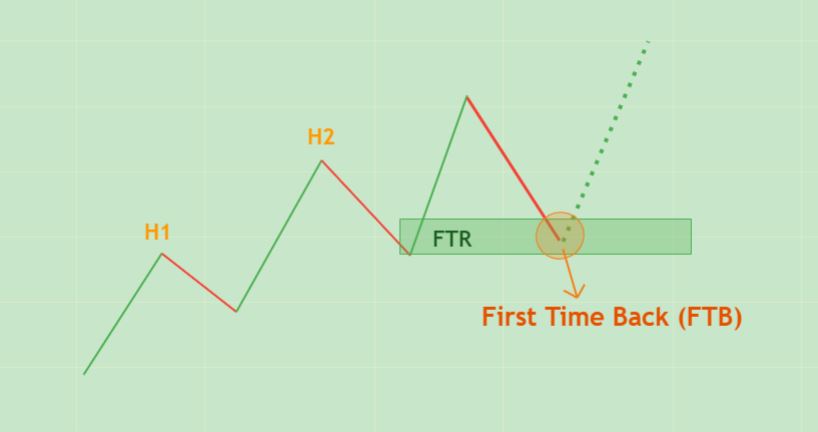

Demand FTR

When price breaks an SR with an impulsive move, creates a new high, and then breaks it; It creates the FTR demand. Draw your demand zone at the base of the immediate impulsive move that breaches the created new high.

When the price is in an uptrend, institutions, big traders push the price down to recollect the orders by creating liquidity at this level.

Rules of FTR Demand zone:

- H1 is formed

- H1 is engulfed upside

- H2 is formed

- The base is formed

- H2 is broken

or,

- The market breaks a supply zone

- Creates a new high

- Push back

- Creates a base/demand zone

- Breaks the new high

Let’s look at an example.

Above is a simple example of what a bullish FTR actually looks like. Here, the market was on a downtrend for a short time. It was continuously creating the supply zones. Then Price breaks the immediate supply zone and creates a high. It pushes back and creates the base/demand zone. Then price breaks the new high and the demand zone becomes an FTR demand zone. When the market pushed back to the qualified zone, it gave me at least a 1:3 risk-reward ratio.

FTR increases the working possibility of the regular demand zones.

Supply FTR

When price breaks an SR downside with an impulsive move, creates a new low, and then breaks it, supply FTR is created. Draw your supply zone at the base of the impulsive move that breaches the low.

When the price is in a downtrend; institutions, big traders push the price up to recollect the orders by creating liquidity.

Rules of FTR Supply zone:

- L1 is formed

- L1 is engulfed downside

- L2 is formed

- The base/supply zone is formed

- L2 is broken

or,

- The market breaks a demand zone

- Creates a new low

- Push upside as correction

- Creates a base/supply zone

- Breaks the new low

Here price breaks the first low by creating another new low. After creating the base, it also breaches the new low, and it creates a valid FTR supply zone.

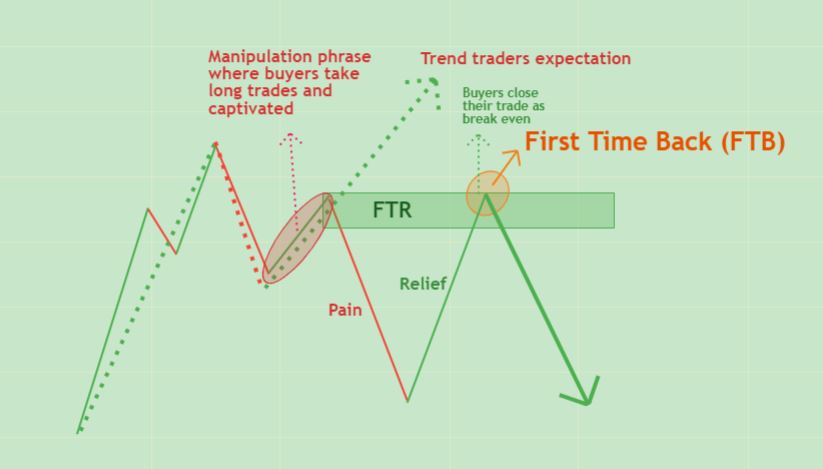

FTB

When the market comes back to an FTR zone that was previously formed for the first time, it is called FTB or First Time Back. It tests the FTR zone during trend continuation.

Remember, FTR is a momentum continuation pattern, and FTB is a trend continuation pattern.

FTB Rules

- Use your preferred timeframe

- Stick with the created trend

- Price Must Create an FTR supply or demand zone

- Price Must Pull Far away from the FTR zone before coming back (At least 10+ pips)

- Waiting for the market to come back and close inside the FTR zone.

- If the market consolidates before coming back to FTR, skip the trade

- See the price action and looks for confirmation

- Place Stop Loss Below/Above FTR zone with breathing room.

- TP should be up to the next trouble area.

How FTR & FTB Work Together?

In the FTR zone, market makers manipulate the traders to trade in the wrong direction. So many traders may wait to close their trade with small losses or break even. Besides, many traders always wait for the FTB to take new trades in favor of the new direction.

Above is a graphical example of how FTR and FTB actually work together. Here, huge captivated buyers are waiting at the FTR zone to close their buy trade in break even. Huge closing of buy trades means huge sell trades. Right? More sellers are waiting to open short trades on the FTR supply zone when the price pushes back to the zone for the first time. These push the market downside.

End Words

FTR and FTB ensure the highest probability of success. But identifying FTR is a little tricky.

So, please back-test it along with other patterns until you become confident to trade with it. When you will get habituated to complex market scenarios, you can easily squeeze the opportunities.

But now trade it with other confluence like Fibonacci, trend-line, moving average, or any other techniques you use in your everyday trading life.

Very good topic forex trading

Waiting your next post

Thank you very much

Subscribe to our newsletter for being informed about our new post. Thank you.