Market manipulation causes the loss of many traders. But some intelligent and proactive traders trade with this manipulation and grow their small accounts with smart money. If you know how the market behaves, you can easily identify the possible manipulation area for taking advantage.

The institutional candle is an outstanding concept of pure price action trading. It is a standalone powerful forex trading strategy that is followed by many price action traders.

What is Institutional Candle?

The institutional candle is the last opposing one or multiple close candles before a strong directional move. So, late buying or selling candles with one or more candlesticks run out of liquidity before heading in the intended direction are called institutional candles. It means institutions sell before buying and buy before selling. That’s why the institutional candle is also called ‘Bankers Candle.’ It is one of the most popular smart money forex trading concept.

Basically, it is the manipulation phase or tricky area where big banks, institutions manipulate the market for liquidity. You can easily identify this institutional candlestick pattern in charts with your naked eye. You don’t need any institutional candle indicator to look for it.

Why do institutional candles form?

Whenever there is a buyer, there’s must be a seller. So, there must be somebody on the other side to take the trade. That’s why market moves and institution candle comes to play as a fishing worm of smart money to grab the liquidity.

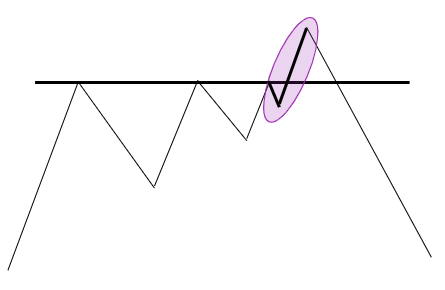

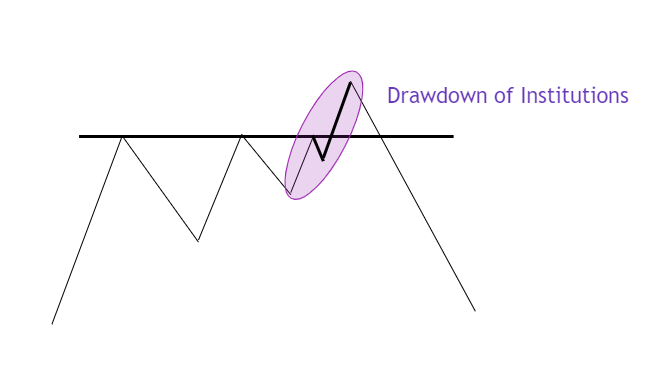

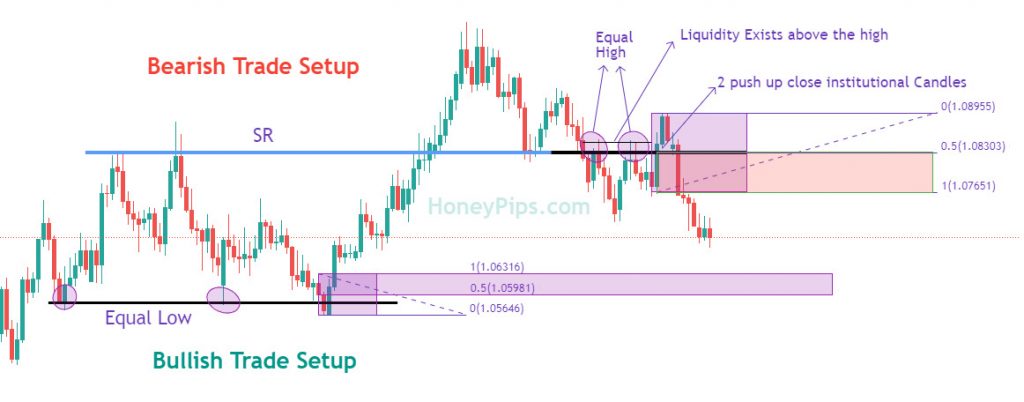

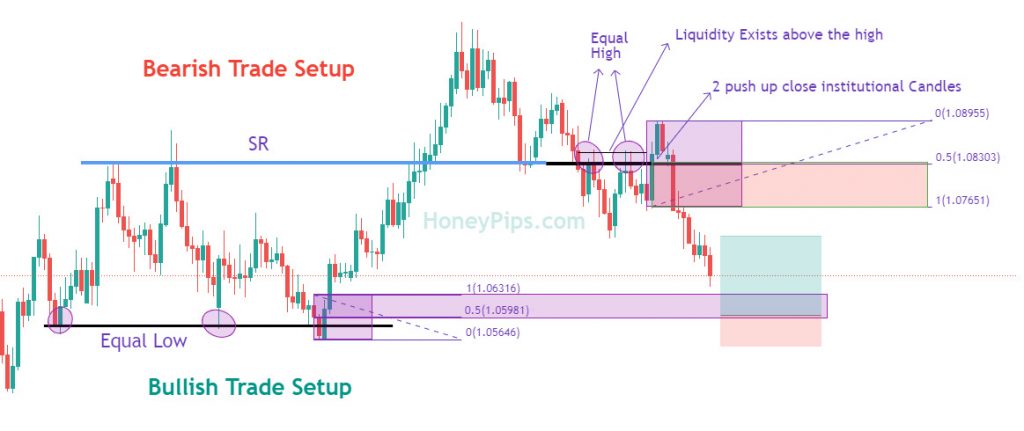

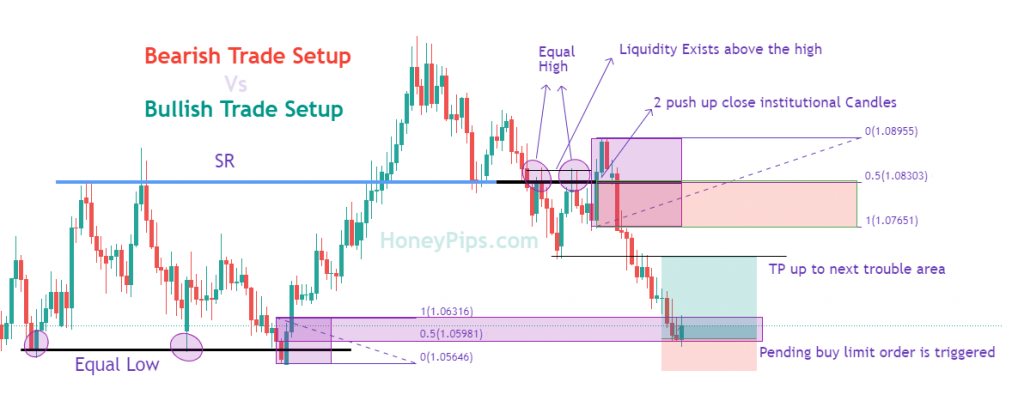

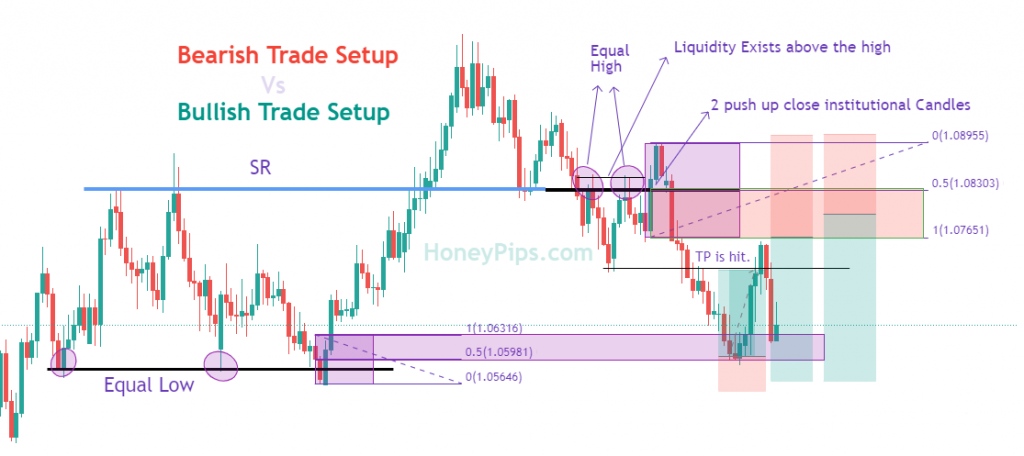

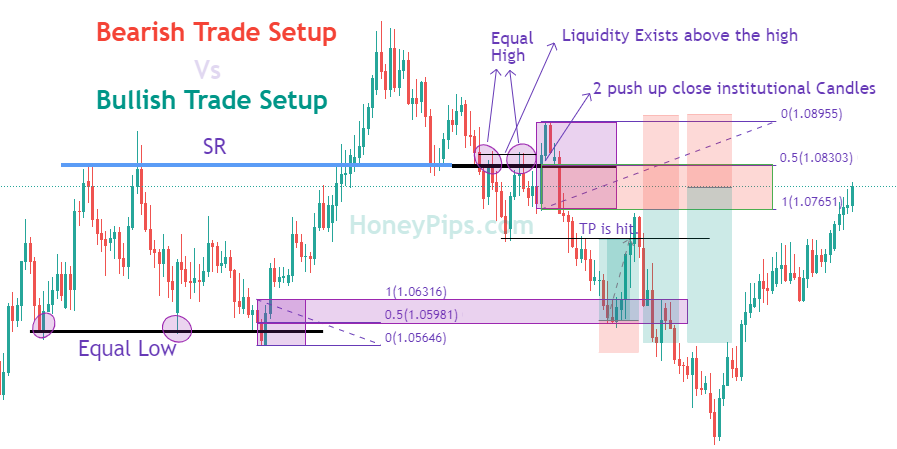

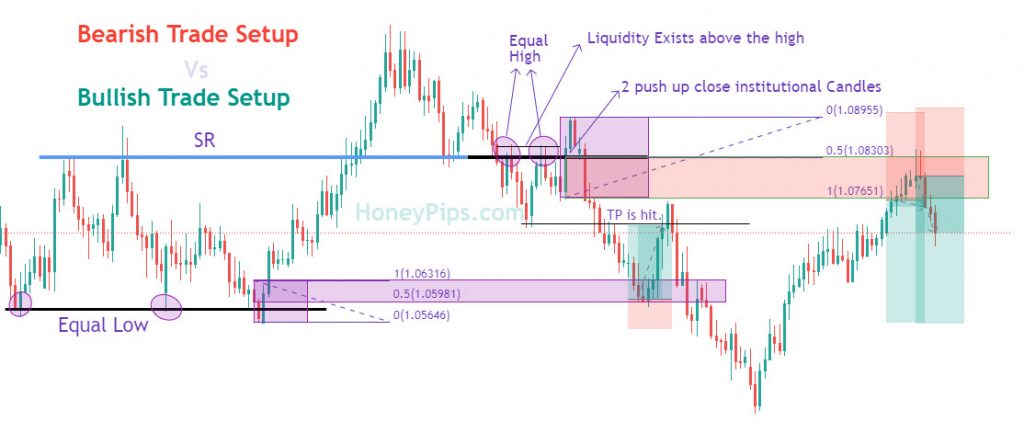

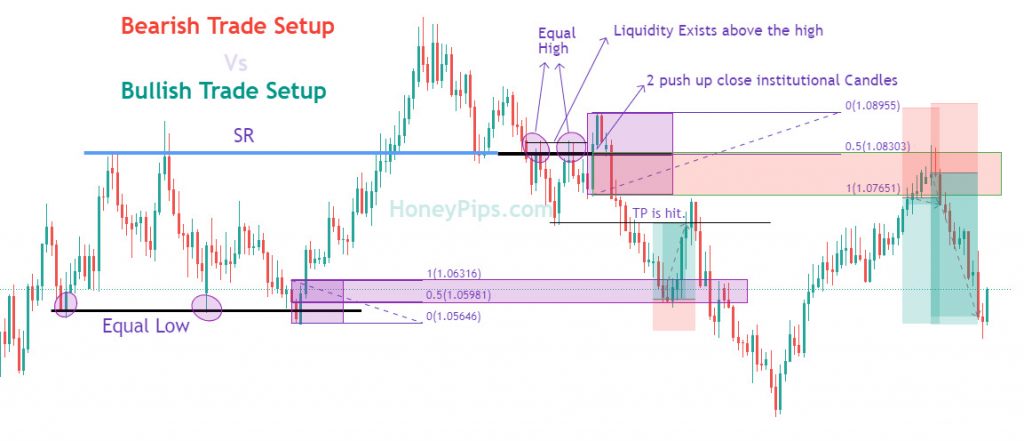

Generally, the stop loss is placed above the swing high (For sell order) and below the swing low (For buy order). When institutions, big banks want to sell, they need buyers. Right? So they breach the immediate high with a big bullish candle with small or no wick. You might see one big candle push in 4H, but multiple candles push in the 15M or 5M timeframe. Remember, in the formation of institutional candles, the number of candles is not important. It may be one or more. The crucial thing is the intention of the candles or push; which is to run out of liquidity.

However, the stop losses of early sellers are triggered by this push, which is placed above the high. We know the seller’s stop-losses are the buy stop orders. Besides, the buy stops of breakout traders also exist above the high. It has also triggered their deliberate buy-stop orders. Then institutions grab all the unwilling & willing buy orders as liquidity, and their intended bearish market movement has started.

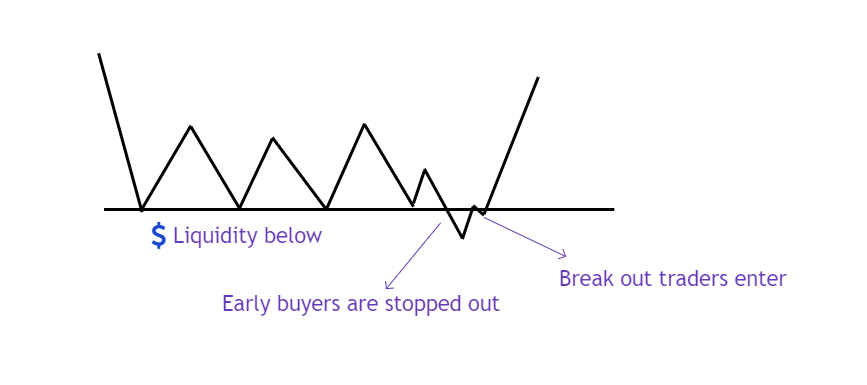

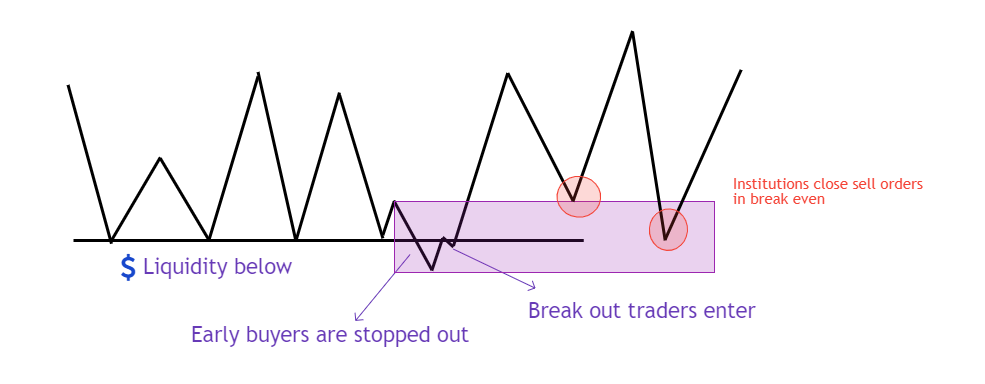

The same case happens in the bullish move. price breaches the immediate low/support with a big bearish candle with small or no wick. It can be multiple candles as well. The stop losses of early buyers are triggered which are placed below the low/minor SR line/support. We know the buyer’s stop-losses are the sell stop orders. Besides, the willing sell stop orders of breakout traders also exist below the support, which are also been triggered. Then institutions grab all the unwilling and willing sell orders as liquidity, and their intended upward market movement has been started.

So, the agenda of the institutional candle is to take out the liquidity above or below the immediate SR line.

Why do institutional candles work?

The institutional candles work because these are the drawdown of smart money.

So, when the price comes back to the zone, they close the order with a small loss or break-even. As they mitigate their position, these are the best place to trade and make some profit along with smart money.

Why institutional candle is important?

Institutional candle helps you to determine order flow and market structure. It is also a popular entry strategy. Dominant trade setup can be placed after the last push up or down close candle; which is also an important strategy that many traders follow. Actually, institutional candle forms swing high or swing low. So, the market never violated beneath the low of last down closed candles in the bullish market and never violated above the last up closed candles during the bearish trend.

How to trade with Institutional Candle?

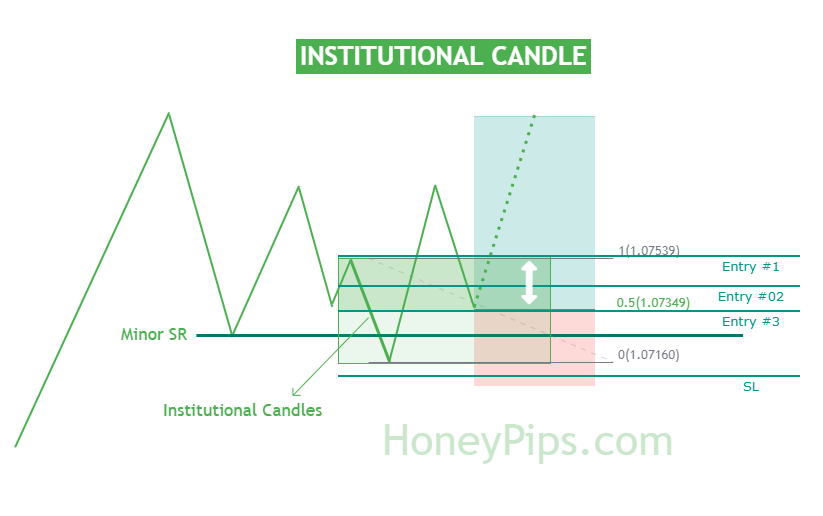

First of all, you have to mark up your major swing points that are formed by the institutional candle. Remember, in the upward momentum market last down close candles are respected, and last up close candles are respected in the bearish trending market. In the consolidation period, both types of institutional candles are respected.

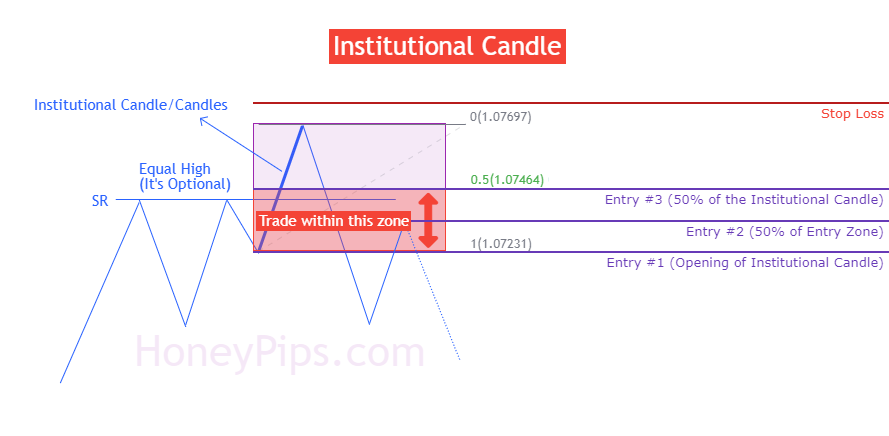

You can execute a trade anywhere within the institutional candles. But traders prefer to enter either at the opening price of institutional candles or 50% of the push. So, you can trade within fib1 to fib0.50. This is your tradable zone. I prefer to trade at further 50% of tradable zone. It’s up to you. But your stop loss should be placed above the institutional candles for the sell orders and below the down-close institutional candles for the buy orders. You might place your SL above or below the institutional candle’s body or wick. I prefer to place my SL above or below the wick. This is the best and safest place to place your stop loss.

If you trade at 50% of the institutional candle, you may miss some of your entries. Because price never always returns to the 50% level. But if your market execution order or pending order is executed at the 50% level, you will get a better risk-reward ratio.

Your TP should be placed at the next trouble zone, next low/high, SR, SnD zone, equal or triple lows on which liquidity exists to drive the market to the opposite direction. You can also place your take profit by analyzing the higher time frame. I think the bigger win rate is more important than the large risk-reward ratio. So, you should cut over expectations and place your TP at a specific, logical. area and be consistent on it. Always try to catch the smallest stop loss possible to maximize your rewards.

I have place one sell limit at opening price of the institutional candle. Another sell limit has placed at 50% of tradable zone. Their TPs are same.

When you are looking at the chart for institutional candles, give extra attention to the body of the candles, not in wicks. The majority of the volume is held by the body. Big ballers are trading there. Wicks are not so much important as retail traders trade there. You may switch to the line chart in tradingview for getting a clear view of the market.

So, you have to identify equal low, equal high, or SR levels, where possible manipulation may occur, and the institutional candles might form. Then you have to mark up the candle. It might one candle in the higher timeframe and multiple candles in the lower timeframe.

Bottom Line

Now you know how to spot smart money movement. Institutional candle is an advanced price action trading concept. You should test this strategy in your demo account first. When you will get positive results then you should implement it in your live account.

You can watch the below playlist for better understanding the institutional order flow, institutional candle, liquidity void etc.

Keep going..its very usefull for a new traders to develop thier startegies..thumps up..