A perfect entry point in forex is difficult to find out. Right?

Regardless of the type of trading strategies and market environment we seek to trade, all of us are still confronted with the choice of how to exactly enter the market, what kind of entry confirmation we should look for, where is our exact forex entry point.

How to enter a trade in forex trading?

Our strategy can find an area of interest we are looking for. It’s a price action area where we expect a change of state in the instrument. But it is not an exact market price on which we can pull the entry trigger with confidence.

Entry confirmation is needed here. It helps us to determine the best forex entry point or exact market price to enter a trade and to formulate our trade entry strategy.

What is forex entry point

The forex entry point is the exact level or price at which a trader enterers a trade at most successful moments in which it is profitable to open a deal.

Why forex entry point is important?

Once we identify the trend of the market and ready to trigger a trade in a potential trade area, we have to find an entry confirmation for trade entry at the best trade entry point.

A perfect trade entry strategy will keep us out of random trades. It finds out quality trade in forex, on time, with solid entry signals that behaving the way we would expect in our potential trade area.

Every forex trader has a strategy for trading profitably. It may be supply and demand trading strategy, price action trading strategy, trade with Elliott wave, or others. Most of traders can easily identify potential trade areas. But most of them have no perfect entry strategies to hunt qualified entry point.

They trade blindly. It’s the same approach as crossing the street without having a look both ways. Though they have profitable trading strategies but they don’t know how to determine entry and exit points in forex. They probably asked themselves the following questions multiple times:

- When’s the best time to enter a trade?

- How I enter?

- Am I entering too early?

- Do I need to wait for another candle?

- What are prescribed to look for?

If the traders knew the answer to those questions, forex trading would be a lot easier. But they don’t.

If you are one of them, have a forex trading strategy, and capable to trace potential trade areas but don’t know what to do then, how to identify entry and exit points, when to pull the entry trigger, then this article is for you.

Here we have covered some forex entry strategies to find out the perfect forex entry point for you. These are the scanners of your identified potential trade areas for searching forex confirmation entry.

A good entry confirmation strategy or entry technique can boost your overall trading strategy & take it to the next level. It is crucial for proper trade management in forex.

Okay, Let’s dive in.

Candlestick Formation

This is the most common & reliable entry technique that almost every trader follows. Here, patterns such as the engulfing and the shooting star are frequently used by experienced traders.

Candlestick patterns find an exact entry price at which the predicting future direction of the asset’s price movement may start. It gives the traders a higher probability of success.

It is the most popular component of technical analysis, enabling traders to trigger a trade.

Pros & Cons

- Suitable for intraday traders.

- The most popular and common entry confirmation to find a forex entry point.

- Suitable for traders who are very much suspicious.

- Suitable for active traders.

- The entry and stop losses can be easily defined.

- As lots of trader’s eyeball is stuck on this common formation, it may not work.

Chart Patterns

Using chart patterns as entry signals is one of the most utilized trade entry tools by traders. It helps us to spot the origin of all major price moves before they actually happen so that we can ride them out.

It indicates whether the price will continue in its current direction or reverse.

Though the trading chart pattern is a standalone-trading strategy, it can be a great entry technique as well.

Some popular chart patterns are:

- Head and shoulders

- Double top

- Double bottom

- Rounding bottom

- Cup and handle

- Wedges

- Pennant or flags

- Ascending triangle

- Descending triangle

- Symmetrical triangle

Pros & Cons

- It is an early/momentum entry technique.

- Easy to spot.

- Takes a long time to develop.

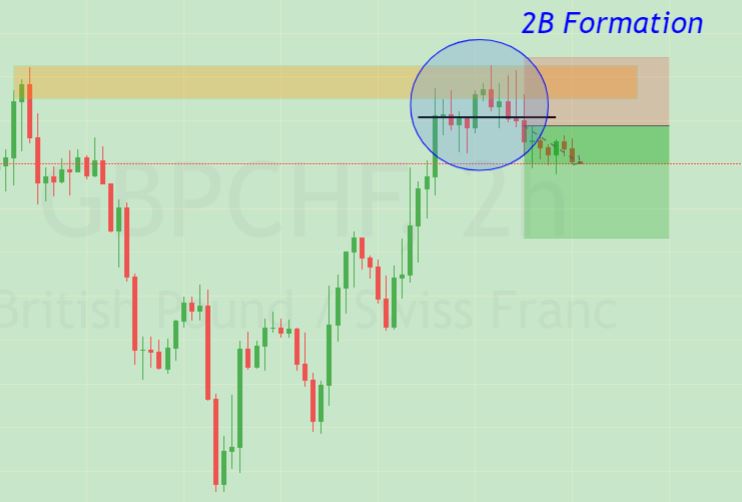

2B Formation

Spring is the another name of 2B. This entry technique has been first introduced in the book of Victor Sperandeo who is also known in traders’ community as Trader Vic.

In his book “Principles of professional speculation” Victor Sperandeo describes Trader Vic’s 2B pattern as follows: “In an uptrend, if prices penetrate the previous high, but fail to carry through and immediately drop below the previous high, the trend is apt to reverse.” The converse scenario is also true for a downtrend.

It looks like a wonky “M” or “W” with false breakout and signals a trend reversal.

Price attempts to test a recent high or low, but fails to continue up or down. A trade is entered to buy the high of the candle trying to break down, or sell the low of the candle attempting to break out.

Pros & Cons

- A momentum entry technique

- Less problematic to identify exact entry.

- Takes a long time to develop.

- Suitable for traders who want to monitor price action development less intense.

- Fear of real breakout.

V Formation

It’s not the typical V formation in which an asset’s price falls sharply and then rises sharply. You have to measures the strength of price falls comparing to rise and vice versa to make a trade execution decision on its pullback.

Pros & Cons

- Momentum based entry technique.

- Stop losses are easily defined.

- Exact entry points can’t be easily defined.

- Price may not pullback.

Dominant Trade Setup

The dominant trade setup is one of the entry techniques that can optimize your trading plan.

Sometimes you may notice an unusual opposing momentum candle penetrates to your potential trade area with very small or no wick. It makes you confused & frightened to trigger the planned entry. And then, the price starts to go on your way before you take action. Right?

To enter a trade under the dominant trade entry strategy, you should have much confidence in your potential trade area, then you have to wait for a forceful penetration with an opposing candle. Now you can execute a trade.

Pros & Cons

- Suitable for traders who are very active in the market.

- Suitable for traders who have an intuition about market sentiment.

- SL range can be reduced.

- Fear of opposite directional momentum.

Stop Loss Range

Traders who are very much conservative about their stop loss will love this entry strategy.

Here, you have to identify the point on which your placed stop-loss is probably safe. Then wait patiently for the price to come to the potential trade area & reach your stop loss range (Suppose, 15 Pips). Now, your limit order is triggered & you wouldn’t take a single pip more stop-loss than planned 15 pips SL.

Here’s an example: EUR/USD is trading at 1.1220. You always keep your SL 15 pips. You believe the price will dip slightly before trending back up and your stop loss should be placed around at 1.1185, then you have to set a pending order at 1.1200 – the point you expect the price to drop before rallying – to ensure you will enter the trade nearest to the bottom of the trend with planned stop loss.

And, of course, you have to consider the spreads of your broker for this entry technique.

Pros & Cons

- Suitable for traders who have tight stop-loss.

- Possibility of missing the trade.

- Possibility of being stopped out by spike.

- FOMO (Fear of missing out) traders can’t stick to it.

- Traders can enter a trade at a specific value.

Counter Trend Break

Counter-trend is a line that is opposite to the primary trend.

You can draw a counter-trend in potential trade area & wait to break it. When the minor short term trendline breaks & price starts to go on your predicting direction, you can take the trade.

It is much simple but efficient way to take a safe trade.

Pros & Cons

- Momentum entry confirmation.

- A higher chance of skipping sideways price action.

- Possibility of catching the faster impulsive part of the market move.

- Fear of false breakout.

Which Trade Entry To Choose

You have to protect your investment at all costs. Otherwise, you can’t survive in the trading world. Think logically before executing a trade to avoid possible loss.

You might estimate that the value of a currency pair will appreciate, but if you hesitate to execute a trade, you limit your potential profits. Entry techniques remove the hesitation and build up the confidence to enter into a trade.

You can choose one or two entry techniques considering your behavior. trading style and your strategy to find the exact forex entry point. Choose one or more entry strategies or techniques that mean to you and stick to it.

Bottom Line

Behavioral economists have demonstrated that people make automatic, unconscious decisions when trading the markets.

So, whatever entry strategy you decide to use, it is always important to plan the trade and wait for those market circumstances to emerge for getting a strong forex entry point. The main rule of effective trading is to execute a trade with solid entry confirmation at that certain point.

You often tend to make poor decisions without trading entry rules or entry techniques.

Don’t chase the market just because the price is actively moving. Remove yourself from making emotional trades.

I hope, this article helps you to formulate the working trading entry rules and boosts your overall trading strategy.

For more information you can checkout this video:

Very good article.

Thanks

Guide me to learn entry. still newbie that search for success